As a Walmart supplier, dealing with deductions is an unavoidable part of doing business. These deductions, ranging from pricing discrepancies to compliance issues and shortages, can quickly eat away at your profit margins if not handled properly. However, with the right strategies and tools in place, you can mitigate the risks associated with Walmart deductions and safeguard your bottom line.

In this guide, we’ll dive deep into the world of Walmart deduction disputes, exploring the newly launched Accounts Payable Disputes Portal (APDP) and providing you with a step-by-step roadmap to effectively navigate this process. We’ll also discuss how you can leverage advanced automation solutions to streamline your deduction management workflow and recover revenue more efficiently.

Understanding the Shift from Settlement Disputing to APDP

Historically, Walmart suppliers relied on the Settlement Disputing method to manage deductions. This approach allowed for the bundling of multiple deductions into a single dispute, which was convenient for high-volume suppliers. However, the Settlement Disputing method came with its own set of challenges, including delayed payment settlements and a lack of transparency.

In May 2023, Walmart introduced a significant change to its dispute resolution process with the launch of the Accounts Payable Disputes Portal (APDP). This new platform, integrated into the Retail Link ecosystem, has become the primary channel for suppliers to dispute individual deductions. While this shift may seem daunting at first, APDP offers several advantages that can help suppliers streamline their deduction management efforts.

Key Benefits of APDP:

- Streamlined Access: The APDP is conveniently accessible through your existing Retail Link account, eliminating the need for separate login credentials or account setup.

- Line-Level Disputes: The platform allows you to dispute deductions at the specific line-item level, rather than the entire deduction amount. This approach provides greater control and flexibility in addressing individual issues.

- Improved Communication: The APDP facilitates direct communication between your dispute analysts and Walmart’s team, enabling faster resolution of disputes and providing transparency on the status of your claims.

- Standardized Dispute Process: The platform follows a structured process for submitting disputes, ensuring consistency and reducing the risk of errors or omissions in your claims.

Understanding Common Walmart Deduction Codes

To effectively dispute Walmart deductions, it’s crucial to familiarize yourself with the most common deduction codes. These codes provide valuable insights into the underlying reasons for the deductions, allowing you to mount a more compelling case during the dispute process.

Some of the most prevalent Walmart deduction codes include:

Shortage Deductions:

- Code 21: Concealed Shortages

- Code 22: Merchandise Billed not Shipped

- Code 24: Carton Shortage / Freight bill signed short

Compliance Chargebacks:

- Code 64: Early Shipment

- Code 65: Late Shipment

- Code 31: PO number not on the invoice

Pricing Discrepancies:

- Code 10: Discrepancies allowances between the invoice and the PO

- Code 11: Price Difference between PO & Invoice

By understanding these deduction codes, you can more effectively identify the root causes of the deductions and gather the necessary documentation to support your dispute.

Disputing Walmart Deductions on APDP: A Step-by-Step Guide

Now that we’ve covered the key aspects of Walmart deductions and the APDP platform, let’s dive into the step-by-step process of disputing a deduction:

Step 1: Access the APDP Portal

Log in to your Retail Link account and navigate to the Accounts Payable Disputes Portal. This is where you’ll begin the dispute process.

Step 2: Identify the Deduction to Dispute

Use the search functionality within APDP to locate the specific deduction you wish to dispute. You can search by claim number, invoice number, or other relevant criteria.

Step 3: Initiate the Dispute

Once you’ve identified the deduction, click the “Create Dispute” button to begin the dispute submission process.

Step 4: Provide Dispute Details

In this step, you’ll need to provide the following information:

- Claim Number

- Claim Date

- Dispute Type

- Deduction Code

- Disputed Amount

- Supplier Number

- Purchase Order Number

- Freight Carrier

- Shipping Method

- Detailed Description of the Dispute

Step 5: Upload Supporting Documentation

Gather and attach the necessary documentation to support your dispute. This may include proof of delivery (POD), bills of lading (BOL), invoices, and any other relevant evidence that can substantiate your case.

Step 6: Review and Submit the Dispute

Carefully review the dispute details and attached documentation to ensure accuracy and completeness. Once satisfied, click the “Submit” button to lodge your dispute with Walmart.

Step 7: Monitor the Dispute Status

APDP provides visibility into the status of your submitted disputes, allowing you to track the progress.

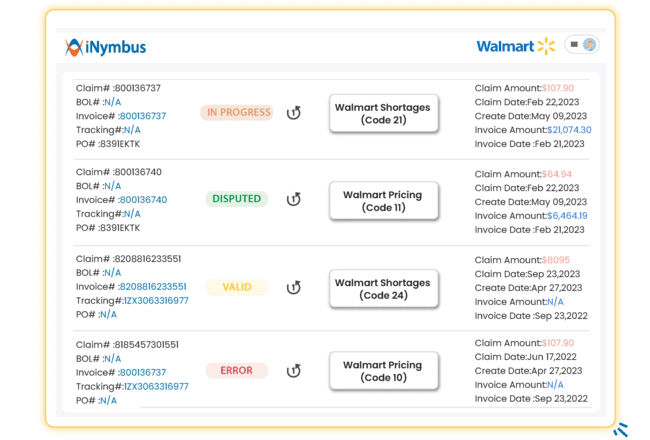

Automating Walmart Deduction Management with iNymbus

While the APDP platform offers a structured approach to disputing Walmart deductions, the manual nature of the process can still be time-consuming and resource-intensive, especially for suppliers dealing with a high volume of deductions.

This is where automation solutions like iNymbus can revolutionize your deduction management workflow. iNymbus is an AR deduction management software, that leverages Robotic Process Automation (RPA) to streamline the end-to-end deduction processing, from identification and classification to dispute submission and payment reconciliation.

Key Benefits of Automating Walmart Deduction Management with iNymbus:

- Increased Efficiency: iNymbus can process deductions up to 30x times faster than manual methods, freeing up your team to focus on more strategic initiatives.

- Cost Savings: By automating the deduction management process, iNymbus can reduce the cost-per-claim by up to 80-90%, delivering significant savings to your bottom line.

- Comprehensive Data Analysis: iNymbus doesn’t just handle disputes; it delves into data analysis to identify the root causes of deductions, enabling you to proactively address underlying issues.

- Seamless Integration: iNymbus seamlessly integrates with your existing tools and procedures, ensuring a smooth transition and minimizing disruption to your operations.

By partnering with iNymbus, you can transform your Walmart deduction management practices, freeing up valuable resources, reducing costs, and driving improved financial performance.

Conclusion

Navigating the complexities of Walmart vendor deduction disputes can be a daunting task, but with the right strategies and tools, you can turn this challenge into an opportunity. The launch of the APDP platform has introduced a more structured dispute process, while automation solutions can further optimize your deduction management workflow.

By understanding the common deduction codes, mastering the APDP dispute process, and leveraging advanced automation, you can minimize the impact of Walmart deductions, recover revenue more effectively, and strengthen your partnership with the retail giant. With these strategies, you can safeguard your profit margins and drive sustainable growth.

Check out our website for more articles on this topic and stay updated with the latest developments!